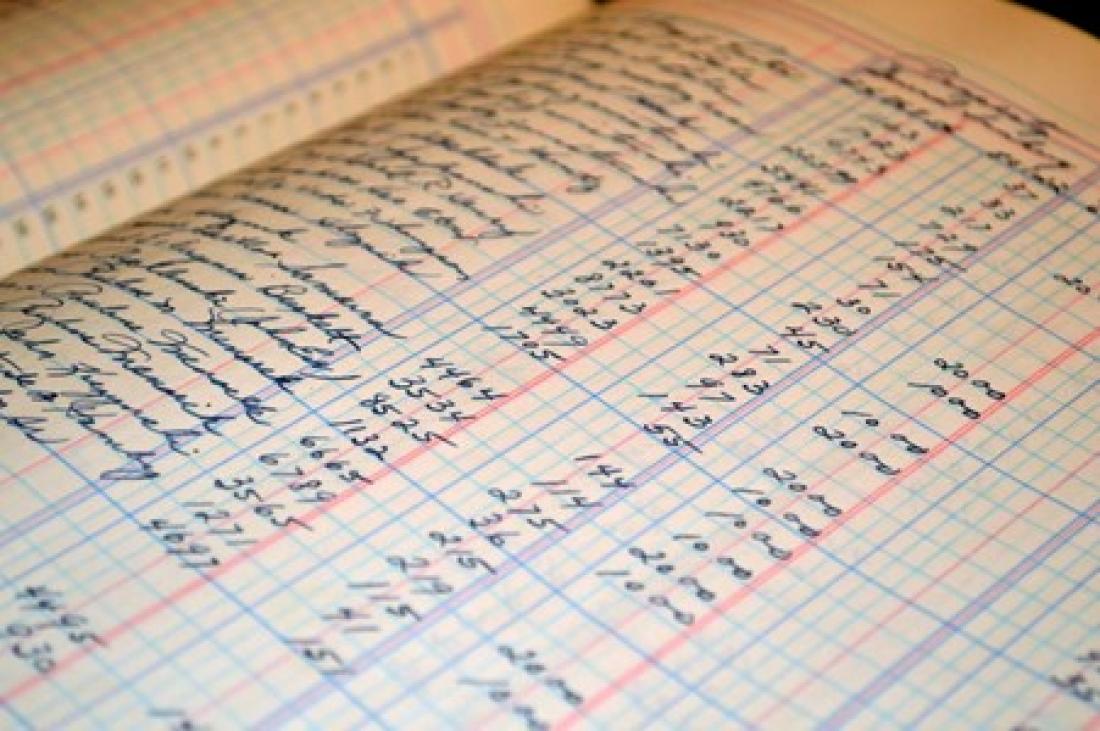

All executors are required to keep accurate and detailed accounts setting out the assets that form part of the estate, details of estate debts and confirming what steps have been taken with assets throughout the estate administration. The accounts also set out how the estate assets have been, or are to be, distributed between beneficiaries.

These accounts can be requested by the Court, particularly where there are suggestions that an executor may have acted inappropriately and so executors should take care to ensure that these are prepared carefully and accurately.

There is no set format for estate accounts, however they should as a minimum detail all estate assets as they were at the date of death, all liabilities and any increases/ decreases in the value of estate assets once they have been liquidated. The accounts also record all costs associated with the estate administration.

Due to the fundamental nature of the estate accounts, some beneficiaries are entitled to see, and approve, the accounts.

Beneficiaries are entitled to certain information depending on their status. If someone is the beneficiary of a specific legacy (i.e. a specific item or specified sum of money) then they are only entitled to information about that asset. The exception to this is if there is insufficient money in the estate to meet all liabilities and the legacies set out in the Will. In this case, the estate assets are subject to abatement in a statutory order. Any beneficiary whose inheritance is reduced as a result is entitled to full copies of the estate accounts.

Where a beneficiary is entitled to the residue of the estate (either in whole or in part) then they should be supplied with full copies of the estate accounts. The executors should get all residuary beneficiaries' approval before distributing the estate. This is because residuary beneficiaries have the right to pursue an executor for any maladministration, mistaken distributions to non-beneficiaries (or distributions of incorrect amounts) or to look for instances where an executor has behaved dishonestly. If the executor has distributed the estate without the beneficiary having approved the accounts then they will be personally liable for any loss suffered by the beneficiary.

However it is not always possible to get beneficiaries to agree to the proposed distributions. This may be for a multitude of reasons, including personal disputes within the family. The risks for an executor (in general) are significant (see my earlier blog) so what do you do if a beneficiary refuses to approve estate accounts?

Where a beneficiary refuses to approve estate accounts, it may be possible for the executor to apply to the Court for their approval of the accounts and to authorise the distribution of the estate. The process can be time consuming and costly, and so should not be approached lightly, but will sometimes be required where it is impossible to reach an agreement. It should be borne in mind that executors are under a duty to administer the estate without undue delay. They are therefore required to take active steps where the administration has stalled and cannot be progressed without the authority of the Court.

Due to the complex nature of such claims, any executor considering this step should seek professional advice. Please contact Ashley Minott at ashley.minott@allanjanes.com or on 01494 893518 if you would like to discuss your role as an executor or the preparation of estate accounts.